Ghc 500 million fund: NFFAWAG Chairman Spells Modalities For Loan Assessment

The desire of the country’s farmers to access stress free credit facilities has received a big boost, thanks to government’s intervention to establish a Ghc 500m cedi facility to support farmers through loans at reasonable rates to sustain their farming activities.

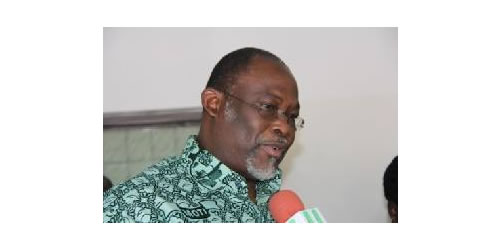

President of the National Farmers and Fishermen Award Winners Association of Ghana, NFFAWAG, Davies Narh Korboe who has been sharing the modalities for the assessment of the facility with Rite FM says the facility will facilitate the loan process for farmers and ease collateral difficulties and challenges of high interest rates farmers endured in their attempts to access loans from credit facilities.

The facility known as the Ghana Incentive Based Risk Sharing Agricultural Lending Scheme, will serve as a loan insurance to farmers through the commercial banks to grant loans at reasonable rates to farmers.

President Akufo-Addo last week hinted of the setting up of a GHc500 million fund by the Bank of Ghana, to support farmers through loans at reasonable rates to sustain their farming activities.

This will be part of policies the President says his government has properly aligned to ensure success in the agricultural sector.

President Akufo-Addo while expressing worry over the lack of attention given to agriculture across the continent, said his government was devising financial instruments that will enable farmers to have access to credit.

The Chairman of the National Farmers and Fishermen Award Winners Association of Ghana who confirmed that part of the amount had already been released to the Commercial Banks in an interview with host of the Rite Morning Ride, Omanba Kwadwo Boafo on Wednesday noted that while the amount will not be shared to farmers, it will be used to subsidize the interest rates on loans granted farmers.

The NFFAWAG boss who doubles as the 2009 National Best Farmer said farmers found it difficult accessing credit facilities from the financial institutions for quality and quantity productions since financial institutions were not adequately informed on farming businesses.

He expressed regret that financial institutions refused to grant loans to farmers on the premise that such investments were risky.

“Financial institutions tag farming as a very risky business to invest in compared to other businesses and for that reason have diverted their focus to this kind of businesses,” he averred.

Spelling out the modalities for accessing the scheme, Farmer Davies said farmers must among other requirements belong to a Farmer Based Organization to benefit from the scheme.

The requirements are necessary to ensure easy recovery of loans to the Commercial banks through which the implementation of the scheme will be done.

The Bank of Ghana is establishing the fund, some GHc500 million, which is roughly over $100 million which is going to act as some form of insurance for the commercial banks to give out loans at reasonable rates to the farmers.

Source: Prince Paul Amuzu/www.ritefmonline.org/princeamuzu667@gmail.com