Cyber Fraud: SEC is collaborating with Foreign Security Agencies to clamp down Loom – Mr. Ashong Emmanuel.

Head of Policy and Research at Security and Exchange Commission (SEC), Mr. Emmanuel Ashong Kataiin an interview with Rite News Department, made it known that SEC is collaborating with foreign security agencies to track down the master minds behind the “Susu” Investment Online called Loom.

According to him, there are a lot of fraudulent activities in the investment scheme that needs to be put to an end. Moreover, the difficulties are, most of these investment schemes are in cyber space making it tough to get those actually behind the scheme.

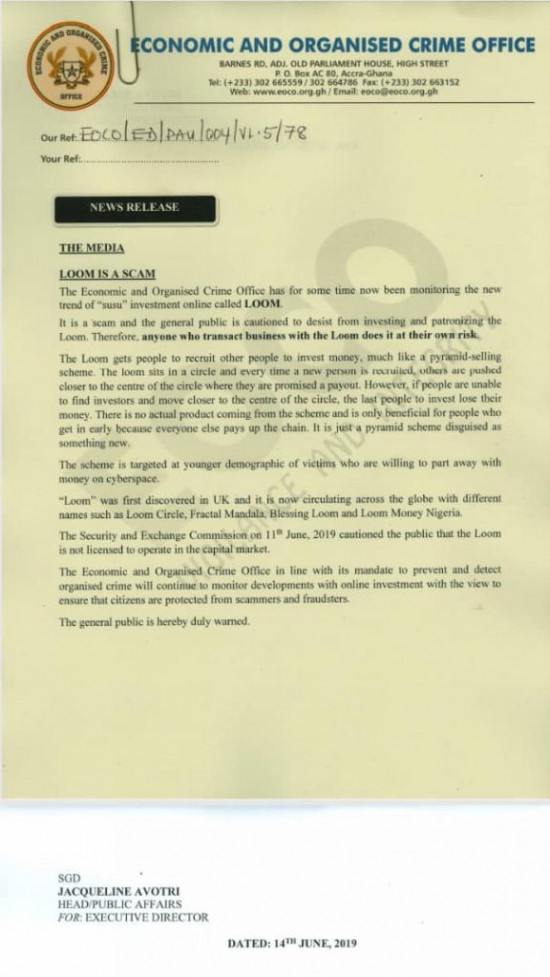

He made his submission following a news release by the Economic and Organized Crime Office (EOCO) after the Security and Exchange Commission on 11th June, 2019 cautioned the public that the Loom is not licensed to operate in the capital market.

However, the EOCO also stated in their news release that Loom is a scam, therefore, the general public is cautioned to stay away from investing and patronizing the investment scheme.

“It is a scam and the general public is cautioned to desist from investing and patronizing the Loom. Therefore, anyone who transact business with the Loom does it at their own risk”, the statement stated.

The office assured that it will keep an eye on how the get-rich-quick scheme unravels.

“The Economic and Organized Crime Office in line with its mandate to prevent and detect organized crime will continue to monitor developments with online investments with the view to ensure that citizens are protected from scammers and fraudsters.”

The pyramid scheme has been appearing in newsfeeds online and circulating on social media.

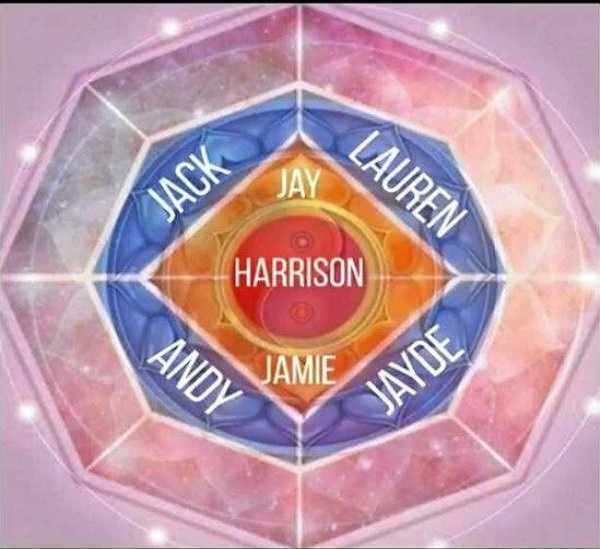

Loom scheme is essentially a pyramid scheme that relies on an individual paying to join in.

The new entrant is then required to recruit other people to join in, who are also required to party with money as well.

For everyone in the scheme to make a profit, there needs to be a constant supply of new members but history has proven that the persons willing to join the scheme and the money they input eventually runs out.

This leaves the members at the bottom of the pyramid making a loss.

“Loom” was first discovered in UK and it is now circulating across the globe with names such as “loom circle”, “fractal mandala”, “Blessing Loom” or “Loom Money Nigeria”.

Mr. Ashong further continued that, though “susu” is legal, license becomes a requirement when the susu regulators begin to solicit funds from the public.

Loom has a website, appearing on newsfeeds online, circulating on social media and inviting individuals publicly without a license makes it illegal and criminal.

However, the SEC is going to collaborate and link up with their foreign regulators to track down those behind this investment scheme and get where exactly they are working from.