Yam production sees less investment

Yams produced in the country, which boast unparalleled premium quality in both ECOWAS and international commodities markets, is faced with unsatisfied demand due largely to lack of required policy interventions, private sector investment and the non-existence of a value chain.

In recent years, the economic value of the country’s yam industry has grown rapidly with its foreign exchange earnings shooting up to the third position among the non-traditional export commodities.

The export volumes for 2014 stood at US$18.8million, while 2013 export figure increased to US$20million whiles demand for the commodity in both fresh and processed forms is increasing in new markets both abroad and local.

The yam export trade which employs over one million workforce is the third largest producer in West Africa after Nigeria and Cote d’Ivoire, but it is the leading exporter of crop accounting for over 94 percent of total yam exports in West Africa. About 90 percent of Ghana’s yams are exported to the US, Canada, UK and Europe.

According to a research conducted by Monitoring African Food and Agricultural Policies (MAFAP) between 2005 and 2010, yam production in the country contributed about 16 percent to the country’s agricultural gross domestic product (GDP), accounting for 11 percent of total consumption in 2007. From 2005 to 2010, yam production accounted for about 24 percent of total roots and tubers production in the country (MoFA 2010).

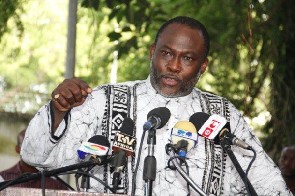

Mr. Kwabena Taylor, Executive Secretary, Ghana Root Crops and Tubers Exporters Union in an interview, explained that the industry faces tremendous opportunities as well as challenges and requires support policies, private sector investment, and to become organized as a whole value chain.

He explained that the yam export strategy is aimed at increasing the export volumes from the current 35,000 metric tonnes to as high as 400,000 metric tonnes and with an expected revenue of about US$5billion by the next five years.

He proposed value addition to the root crop which will position the commodity to be competitive in the international market. “We are thinking of value addition from the processing of yam from the pharmaceutical industry. We need to get ourselves competitive and meet international standards.”

The new strategy, he said, will certainly provide the opportunity to market fresh yam effectively, grow existing markets and expand into new markets, i.e. beyond the West African and West Indian communities.

“We are working on geographical expansion of distribution of yams in the U. S market which holds about 17 percent of the market share and we think that we can increase that. We are also working to export to Japan.”

He proposed the need to work on the right application of fertilizers to be able maximize the use of land, adding that farmers practice fallow system which is not too good. “We should be able to use same land over and over again by the right application of fertilizers.”

Major industry challenges

Last year, out of a possible 100,000 tonnes of yam available to exporters per annum only about 25,000 to 35,000 tonnes get exported, as factors like excessive use of chemicals by farmers, poor handling, and delays at the ports caused the produce perish at a faster rate.

The country thus earns less than a billion dollars from exporting the root tuber, which is supposed to be the third-largest foreign exchange earner among the non-traditional export commodities.

The target, meanwhile, is to do US$5billion dollars of exports by the fifth year of a National Yam Development Strategy that was outdoored in October 2013.

The Yam Development Strategy has five key milestones, including a plan to increase the export of fresh yam.

Practical challenges of the sector and scarcity of funds are hampering the growth of the industry. The practical challenges can be overcome when the country have the right infrastructure and does the right things in terms of monitoring the quality of the yield through its cultivation.

The Yam Development Council is considering introducing to food processors innovations like yam-wine, yam-powder and slicing up the fresh yam and vacuum packing it for export, and even domestic consumption and if the plans materialise, slices of packaged yam could be purchased in supermarkets and sent home to be cooked.

The Yam Development Strategy document is structured that between now and the next five years it is expected to see some key changes in the way the commodity is handled with the yam and the businesses around it.

“The strategy envisions making Ghana the leading source of premium quality yam products with global penetration and contributing to an improved Ghanaian economy and livelihoods.

“One of the objectives of the strategy is to develop commercially-driven research and development as well as capacity building in the yam value chain,” the Council said.

Source: B&F